Banks, micro-finance institutions and insurance firms will now counter fraud incidences targeted to their customers through a fraud intelligence solution launched today by Safaricom.

Safaricom’s Anti-Fraud Intelligence Solution has been designed to complement the internal checks and measures that banks, SACCOS, and insurance firms already deployed against fraud. This provision is an additional measure against which they can verify the legitimacy of the person transacting on the other end with one of the biggest fraud issues being SIM swaps.

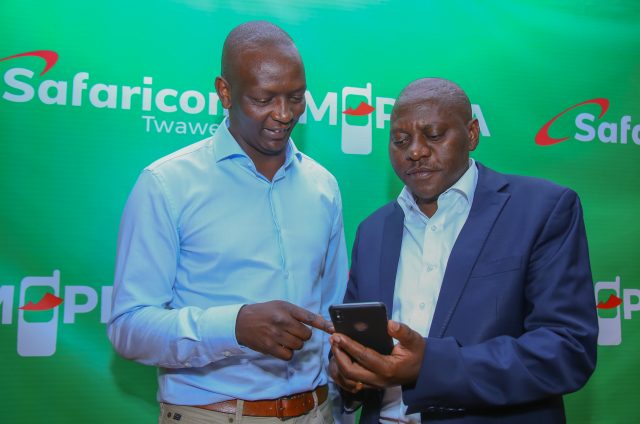

“Through the years, we have developed in-house capabilities that have helped us cut down on attempted fraud incidences targeting our customers by more than 75 percent. Today, we are launching a solution that will provide these world-class capabilities to our enterprise customers in the financial sector, empowering them to make more informed decisions when interacting with their customers in the digital space,” said Sitoyo Lopokoiyit, Chief Financial Services Officer, Safaricom.

The Antifraud tool will not only help with the authentification of financial transactions but also enhance the registration and onboarding of new customers, provide financial firms with capabilities to better design their lending propositions and managing inactive phone numbers linked to a customer’s accounts.

An API provided as part of the Daraja M-PESA APIs will help the financial institutions access the service which works across a number of channels including USSD, internet banking, and smartphone apps thanks to the uptake of internet and smartphone advent. Daraja API that provides fast and seamless integration for anyone looking to provide a service on top of M-PESA.

When a customer tries to log in through any of the channels, the financial institution will then run the customer’s phone number through the service to check against parameters such as recently swapped customer’s number Institutions can then factor in the result of the check to complement internal fraud rules and decide whether the customer will proceed with the transaction or the customer’s authentication will be verified by other means.

The country is expected to benefit, from the adoption of this solution through increased usage of mobile and internet banking as both customers and the financial sector players will have more confidence and faith in the system.